Calculate land value for depreciation

Determine the cost of the asset. It equals total depreciation 45000 divided by useful life 15 years or 3000 per year.

5 Methods To Calculate Land And Property Value In India

Annual Depreciation Cost of Asset Net Scrap ValueUseful Life.

. The land is always valued at market rate while. Value of the land to the building. 1800year Annual Depreciation Rate.

Identify the propertys basis. To calculate depreciation the value of the building is divided by 275 years. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life.

Land value is exempt from depreciation because land never wears out or is used up. How to Calculate Depreciation. June 27 2021 June 26 2021 by Isabella.

Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the market value of the property. Total Depreciation - The total amount of depreciation based upon the difference. Separate the cost of land and buildings.

The Iyers should consider a 13rd deduction in the price of the building. Determine the useful life of the. While calculating depreciation of property factor in the average life of the building and the current age of the construction.

Determine your asset depreciation method. So building price Market price x 13 To this building price the Iyers will also need to add the. This is the most the company can claim as depreciation for tax and sale purposes.

Annual Depreciation 10000-10005. Improvements 60000 75 Land 20000 25 Total Value. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount.

For example the first-year. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. The property tax statement shows.

Ryan bought an office building for 100000. Depreciation expresses the loss of value over time of fixed assets of a business. Here is how to use a property depreciation calculator step-by-step.

How To Calculate Depreciation Expense

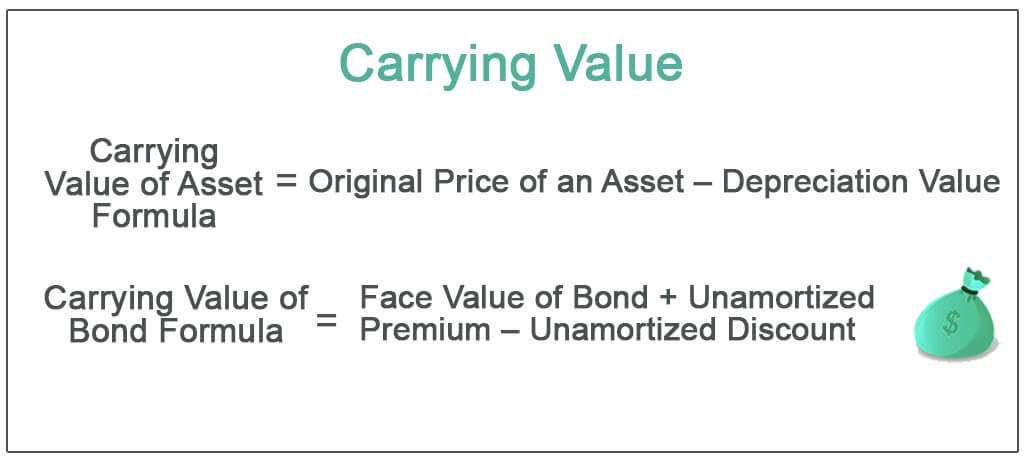

Carrying Value Definition Formula How To Calculate Carrying Value

Salvage Value Formula Calculator Excel Template

Salvage Value Accounting Formula And Example Calculation Excel Template

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

A Map Of Every Non Disclosure State In The U S And How Real Estate Investors Can Deal With Them Real Estate Investor Real Estate Tips Real Estate Advice

Depletion Method Of Depreciation Accounting Education Economics Lessons Finance Class

Calculating The Land And Building Value Of Your Rental Property

Salvage Value Formula Calculator Excel Template

Depreciation Of Building Definition Examples How To Calculate

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

Depreciation Formula Calculate Depreciation Expense

3 Reasons Why Is Property Tax So High In Texas Property Tax Tax Reduction Commercial Property

Depreciation Formula Calculate Depreciation Expense

How To Use Rental Property Depreciation To Your Advantage

Example Of A Property With A Good Cash Flow Return Green Label Positive Cash Flow Cash Flow Statement Cash Flow

Auto Finance Calculator With Trade Fresh Car Depreciation Calculator Calculate Straightline Car Payment Calculator Car Payment Car Loan Calculator